Police outside the corporate headquarters of UnitedHealthcare in Minnetonka, Minnesota, on Dec. 8, days after the company’s CEO Brian Thompson was killed in New York City. (Chad Davis,Wikimedia Commons, CC BY 2.0)

By Derek Seidman

Truthout

The killing of UnitedHealthcare’s Brian Thompson — a brazen assassination of a wealthy CEO in the streets of midtown Manhattan — shocked the United States.

The killing of UnitedHealthcare’s Brian Thompson — a brazen assassination of a wealthy CEO in the streets of midtown Manhattan — shocked the United States.

But the tsunami of mass anger unleashed against a hated for-profit health care system has so far defined the story in the news.

The killing sparked a deluge of personal testimonies of horrifying experiences with health insurance corporations. Dark humor around the shooting continues to flood social media.

Millions of people in the U.S. viscerally hate health insurance corporations, and see these companies and their CEOs as symbols of the worst kind of corporate greed. They enrich themselves by charging huge deductibles and then still denying claims for health care coverage that people desperately need.

These corporations hold the power to ruin lives. It seems as if almost everyone in the U.S. has had a horrible experience with a health insurance corporation.

UnitedHealth Group — the parent company of UnitedHealthcare — is a poster child for this system. It is the biggest health insurance corporation in the U.S. Its top executives rake in tens of millions of dollars.

UnitedHealth Group has faced scrutiny for a range of alleged abuses, such as overcharging on Medicare bills and using AI to reject medically necessary coverage. It’s a leader in an industry that moves to crush any talk of a single-payer health care system.

It’s critical to understand the practices of UnitedHealth and the wider health insurance industry as systemic and bound up with the larger ensemble of corporate rule.

The problem isn’t just that health insurance CEOs callously deny coverage to patients to extract massive profits — it’s that if those CEOs didn’t do this, their boards of directors and shareholders would demand their replacement.

UnitedHealthcare CEO Brian Thompson was just one cog within a larger structure of company executives, corporate board directors, big investors, and an army of lobbyists and industry groups — all bent on preserving the system of private, for-profit U.S. health care that is nearly universally detested and requires collective organizing action to be dismantled.

Massive Profits & CEO Pay

Andrew Witty, CEO of UnitedHealth Group in December. (UnitedHealth Group, Wikimedia Commons, CC BY 4.0)

UnitedHealth Group is a massively profitable corporation. From 2021 to 2023 it took in nearly $1 trillion in revenue and nearly $60 billion in profits.

Last quarter it generated over $100 billion in revenue and $6 billion in profits. It ranks fourth on the Fortune 500 list of top U.S. companies.

The CEO of UnitedHealth — and, as head of UnitedHealthcare’s parent company, Thompson’s boss — is Andrew Witty, who was awarded a knighthood in 2012 by the British royal family and who hobnobs with Bill Gates and advises his foundation.

From 2021 to 2023, Witty raked in nearly $63 million as UnitedHealth’s CEO. Witty’s 2023 compensation of $23,534,936 was 352 times the median employee pay at UnitedHealth. By comparison, Thompson took in just under $30 million from 2021 to 2023.

Witty owns 97,172 shares of UnitedHealth stock, currently worth around $54 million, even as the company’s share value took a hit after Thompson’s killing. (It had reached an all-time high just weeks before.)

UnitedHealth CEOs have a history of receiving astronomical levels of compensation. Stephen J. Hemsley served as UnitedHealth CEO from 2006 through 2017, during which he came under scrutiny for taking home $102 million in 2009 after exercising stock options.

“If CEOs didn’t callously deny coverage to patients to extract massive profits, boards of directors and shareholders would demand their replacement.”

Today, Hemsley remains a powerful figure at UnitedHealth, serving as chair of its board of directors. In 2023, he raked in a whopping $113 million after selling off more of his UnitedHealth stock.

While UnitedHealth’s executives receive huge compensation, they’re not unique within the sector. For example, from 2021 to 2023, the CEOs of the next three largest U.S. health insurers were similarly compensated: Elevance Health’s CEO received over $61 million, CVS Health’s CEO received over $63 million and Cigna’s CEO received over $61 million.

Boards of Directors

Witty and other top UnitedHealth executives, in turn, answer to an even higher authority: UnitedHealth’s board of directors.

Corporate boards are companies’ highest governing bodies. They hire and review top executives and set their compensation. They are tasked with oversight of overall business and strategic risks. Board members annually receive hundreds of thousands of dollars for their board service.

Company boards are interlocked with larger structures of corporate rule. While UnitedHealth is a discrete entity, it’s also a node in a wider web of corporate power — a fact illustrated in the composition of its 10-member board of directors.

For example, one UnitedHealth director, Timothy Flynn, is the retired CEO of KPMG International, one of the “Big 4” global accounting firms. He was a board director of JPMorgan Chase, the world’s top bank, from 2012 to 2024. As of March 2024, Flynn owned JPMorgan stock worth over $17 million today, and he also owns nearly $7 million in UnitedHealth stock.

Timothy P. Flynn in 2009, while chairman of KPMG International, at a World Economic Forum gathering in Dalian, China. (World Economic Forum, Flickr, CC BY-NC-SA 2.0)

Since 2012, Flynn has also sat on the board of Walmart, the world’s top retailer and a notorious union buster, and he owns over $14 million in Walmart stock. He previously served on the boards of aluminum giant Alcoa and insurance powerhouse Chubb, which, along with JPMorgan, have been primary targets of climate protesters for financing and insuring the fossil fuel industry.

Another UnitedHealth director, William McNabb, is the former CEO of Vanguard Group, the world’s second-largest asset manager, and also the top shareholder of UnitedHealth. McNabb is also a board director of computer giant IBM. He owns over $3 million in IBM stock and over $7 million in UnitedHealth stock.

“Company boards are interlocked with larger structures of corporate rule.”

Stephen J. Hemsley, the former UnitedHealth CEO mentioned above, not only chairs UnitedHealth’s board, but is also on the board of Cargill, the largest privately held company in the U.S. Other corporations represented on UnitedHealth’s board, either through current or previous ties to directors, include Google, United Airlines, PPG Industries, Global Payments, SunTrust and Merck.

Like many corporate boards, UnitedHealth has a revolving-door politician in former Massachusetts Gov. Charlie Baker, who joined the company’s board immediately after his last term ended in 2023.

Gov. Charlier Baker (center) in 2016 with General Electric CEO Jeff Immelt (left) and Boston Mayor Marty Walsh at the announcement of General Electric’s move of its headquarters to Boston. (Office of Governor Charlie Baker of Massachusetts, Wikimedia Commons, Public domain)

While company CEOs understandably draw popular ire, they are both incentivized and disciplined by their boards of directors — through bonuses and stock incentives, but ultimately the possibility of termination — toward delivering maximum profits for investors and keeping share prices up.

In other words, under this system, if Andrew Witty or Brian Thompson don’t gouge insurance customers, the board will find CEOs who will.

Big Shareholders

Even UnitedHealth’s board of directors has a higher authority: the company’s investors.

As a publicly traded corporation, UnitedHealth is effectively owned by its shareholders, composed primarily of the largest asset managers and Wall Street banks. UnitedHealth regularly sends billions back to investors — and its own executives and directors — through stock buybacks and dividend payouts.

Please Support CN’s

Winter Fund Drive!![]()

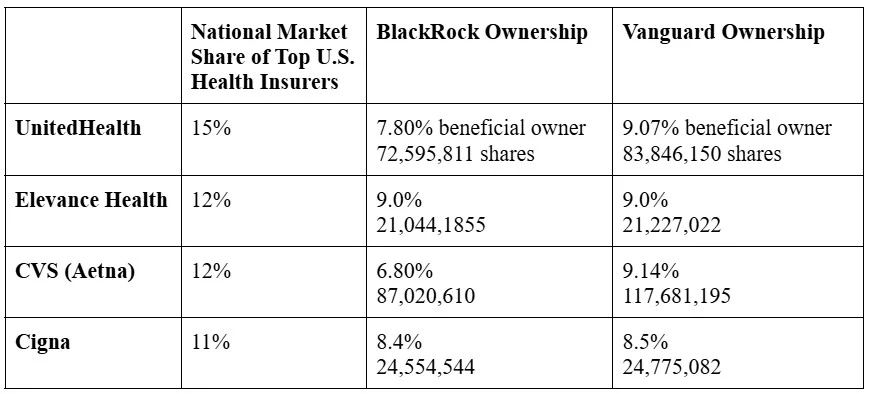

The two top shareholders of UnitedHealth are the world’s two biggest asset managers, BlackRock and Vanguard, which together oversee more than $20 trillion in assets. According to UnitedHealth’s most recent proxy statement, Vanguard is a 9.07 percent beneficial owner of UnitedHealth and BlackRock is a 7.8 percent beneficial owner.

Together, these two firms alone beneficially own around 17 percent of UnitedHealth, holding a combined 156,441,961 shares of UnitedHealth stock worth over $87 billion.

And it’s not just UnitedHealth: BlackRock and Vanguard are the top two shareholders of the top four U.S. health insurers in terms of national market share.

Data based on the most recent proxy statements of UnitedHealth, Elevance Health, CVS (Aetna) and Cigna published earlier this year. Exact numbers of shares and percentages may have fluctuated since then but the basic picture remains the same. (Derek Seidman)

Other Wall Street firms, like Fidelity, State Street, JPMorgan, and others are also huge shareholders of UnitedHealth and the other health insurance giants — just typically more in the 2-4 percent range.

The top 10 shareholders of UnitedHealth together have a 41 percent ownership stake in the corporation. Some of these firms are led by hugely influential billionaires, including BlackRock’s Larry Fink, Fidelity’s Abigail Johnson and JPMorgan’s Jamie Dimon.

While these top shareholders in health insurance corporations are so-called passive investors who invest widely across the entire corporate spectrum, they hold the power to compel changes around exploitative companies and industry practices if they choose.

Lobbyists & Campaign Donations

UnitedHealth can only pursue its insatiable quest for profits with the assistance of well-compensated lobbyists.

In 2023 and 2024 alone, UnitedHealth has spent $23,885,000 on federal lobbying carried out by an in-house lobbying team and nine outside lobbying firms. These lobbyists include influential former government officials and staffers with bipartisan ties.

On the Democratic side, UnitedHealth lobbyists include the former chief of staff for House Democratic Leader Hakeem Jeffries; the former director of legislative Affairs for then-Vice President Joe Biden; the former executive director of Nancy Pelosi’s campaign committee; the former chief of staff to former congressman and top Biden administration adviser Cedric Richmond; and a top fundraiser for House Democrats who is the former chief of staff to former House Democratic Leader Dick Gebhardt.

On the Republican side, UnitedHealth lobbyists include the former chief of staff for Sen. Mitch McConnell; the former chief of staff for Sen. Ted Cruz; and several officials from George W. Bush’s administration.

Additionally, in the 2024 election cycle, UnitedHealth’s PAC donated hundreds of thousands of dollars to federal and state politicians across the political aisle, including $15,000 each to both Democratic and Republican House and Senate campaign committees.

They also gave thousands to key congressmembers who sit in influential positions on committees that oversee and regulate the health care industry.

Industry Groups

However, much of the heavy lifting of defending the interests of health insurance corporations isn’t done by individual companies, but by their industry groups.

These industry groups unite the resources of entire corporate sectors to advance their agenda with a single voice. Big Oil has the American Petroleum Institute. Big landlords have the National Multifamily Housing Council. For health insurers, the key industry group is America’s Health Insurance Plans (AHIP).

AHIP’s board is composed of the CEOs from top U.S. health insurance companies. The president and CEO of AHIP is a former top executive from UnitedHealth, and the head of AHIP’s federal lobbying operation also previously worked for UnitedHealth.

“Industry groups unite the resources of entire corporate sectors to advance their agenda with a single voice.”

AHIP has spent over $26 million lobbying the federal government in 2023 and 2024, using in-house lobbyists and — like UnitedHealth — hiring nine outside lobbying firms similarly filled with former government staffers and officials. AHIP is also a major donor to political parties and elected officials, including the Democrats and their top leaders.

As the vehicle for defending the generalized corporate interests of health insurers, AHIP tries to destroy anything that threatens the for-profit health care system, especially single-payer health care.

In June 2018, AHIP joined other health care industry groups like Pharmaceutical Research and Manufacturers of America and the Federation of American Hospitals to create the Partnership for America’s Health Care Future, an astroturf operation aimed at crushing Medicare for All.

Taking on the System

Some health insurance executives are lamenting that they’re being cast as villains for simply “playing their role in the system,” according to The New York Times.

What’s omitted here is that health insurance corporations are not passive functionaries within the U.S. for-profit health care system, but active defenders of that system that mobilize campaign donations, lobbyists and industry groups to stamp out alternatives like a single-payer system that would cut out rapacious middleman profiteering from health care.

But the current groundswell of anger around the U.S. health care system should embolden new efforts to push for a single-payer, Medicare for All system — a demand for systemic change that could be a unifying anchor for a broad challenge to Trumpism and corporate rule exercised through both political parties.

UnitedHealth and other health insurance companies are part of a larger apparatus of corporate rule that must be combated through collective action focused on building the power needed to achieve systemic change.

To take on this megastructure, we will have to build our own counter structures, like grassroots and labor single-payer campaigns, debtor organizations, trade unions and tenant groups, and engage in confrontational political efforts and general strikes.

It’s clear we are living in a period of rising anti-systemic feelings and widespread anger at corporate profiteering over every aspect of our lives, from health care to housing to work. The time is ripe for building the collective organizations and capacities we need to challenge the structures that reward and enable corporate CEOs’ abuses.

Derek Seidman is a writer, researcher and historian living in Buffalo, New York. He is a regular contributor for Truthout and a contributing writer for LittleSis.

This article is from Truthout and republished under creative commons license CC BY-NC-ND 4.0.

The views expressed are solely those of the author and may or may not reflect those of Consortium News.

Please Support CN’s

Winter Fund Drive!![]()

Make a tax-deductible donation securely by credit card or check by clicking the red button:

Collective resistance campaigns??? Are you NUTS??? The government should step in and put an end to these miserable thieves. But of course…the government is in CAHOOTS…so don’t get your hopes up expecting change.

Perhaps Abraham Lincoln was not just blowing political hot air a century and three score ago when he asserted that “you can’t fool all of the people all of the time”, on the other hand, it seems clear that the few can steal from the many all of the time.

At the very least, we should use this opportunity for mass education/agitation against people enrolling in “Medicare Advantage” plans. Let’s let people know that an irrevocable decision to enroll in a “Medicare Advantage” plan instead of regular Medicare, might look attractive at 65, but will likely lead to bankruptcy or death a few years later, while enriching United Healthcare and other corporate leaches and bankrupting Medicare.

The trouble is, congress has made it extremely risky to have regular Medicare which only covers 80%. You have to pay for gap coverage and there is no cap on out of pocket expenses should you become critically ill or suffer a debilitating accident. It’s also extra for vision and dental. That’s what pushes people into the Medicare Advantage system.

We must demand a national health service that covers everyone. No exceptions. At this late stage of corporate control, that will mean taking serious mass action to challenge the system. It’s do or die time. Apathy is no longer an option.

Right on Lois Gagnon!

Wow!

That is basically a humanitarian defense statement for a population subjected to corporate hegemony.

Thank You for doing our homework.

About that lame justification that corporate actions are all for their millions of investors, the stockholders… First of all, this leaves out the actual people by which these corporate “persons” are enabled to provide the goods and services from which they rake in the trillions–their employees. The vast majority of whom are invisible and not well paid. Whose interests are omitted by design, yet corporate profits depend on them.

Then look at how many of these alleged investors are other corporations; bloodless, soulless “persons” who thrive on the misery of real people. Worst of all the financial institutions that manipulate abstractions to the benefit of the few.

Besides, the Stock Market is a de facto gambling den. Although it’s not exactly gambling if you have insider info. But that’s unfair and illegal, so of course it never happens. Right. Consider also that when these gamblers exchange stock among themselves, that’s NOT investing; it’s like when you buy a used truck–what you paid doesn’t go to Ford.

The most egregious scam is stock buybacks by corporations. Which used to be limited by law to 2% of profits and now is not uncommonly 90%+. This means no $$$ for expansion or R & D. But it’s great for stock compensated CEOs and financiers since they benefit personally not only by stocks bought by corporate funds, but also by the artificial inflation of share price.

Stock buybacks are unconscionable. They are financed by mass layoffs that have affected millions of working people. Why allow it at all? Especially corporations bailed out with public money or that receive government contracts. The issue would have been a winner for the Ds, but not a word. Their corporate sponsors wouldn’t have liked it. For great stats on this issue, see Les Leopold’s blog or his 2024 book //Wall Street’s War on Workers (How Mass Layoffs and Greed Are Destroying the Working Class and What to Do about It)//.

It’s all in a days work for capitalism. That is all capitalism, late capitalism, neo-liberal- gangster-capitalism that you describe. It should be abolished, along with the Pentagon and CIA. While it is tempting to wish for the assassination of the CEOs and the ownership rentier class, the best thing to happen to them is that they be made to live like everybody else: work a crappy part-time job, with low pay, no healthcare, stupid obnoxious supervisors, crappy hours, dangerous places and situations, trying to keep and maintain a car, a crappy apartment in bad neighbourhood, the lot of the 99%. The very wealthy never pay in any way for anything.

I was a blue collar worker for close to 30 years–I’d love to see that happen!!! The few who have some measure of empathy might learn something.

Most likely the innate econopaths would still manipulate their way to dominance. Colin Wilson, the working class self-educated polymath Brit, wrote a book //The Criminal History of Mankind// where he argues there are 5% hyper-aggressive, cold hearted humans, almost all male. If they come from privilege…well, we know. If they don’t, they run criminal enterprises. It’s hard to tell them apart.

I’d argue we’re around 80%. The 99% figure is for elitist U.S. Dems (+ Libs/Labour) to pretend they’re with us. They’re the 15-19% admin. and professional upper middle class. Who aren’t hurt by trickle up and as bureaucrats keep the system going. The only alternative is for us, the vast majority, to insist econ and pol systems are aimed at the common good. The ~90% support for the UHC assassin is proof we aren’t limited to right-centrist-left.

Late 19tn, early 20th centuries, quite a lot of the rich and powerful were assassinated by “anarchists” (lone nuts with weapons”. Think of Pres. McKinley or Austrian Empress Elizabeth. is this assassination the beginning of a trend? I expect CEOs and other plutocrats are up-grading their guards. But who guards you from your guards?, as Roman author Juvenal said.

Robber baron Jay Gould famously said he could hire one half of the working class to kill the other half.

We must be smarter than that, refuse to kill each other and wake up to the fact that nothing will improve until it is the robber barons that are killed.

JFK said that if you make peaceful reform impossible, you make violent revolution inevitable.

All legal regulatory and judiciary checks and balances to peacefully reform corporate crimes have been dismantled by the corporate criminals.

Which is the greater crime:

The mass murder of millions of innocent people by psychopathic robber barons motivated by their greed:

Psychopaths who steal oil and land (Iraq, Palestine), who sloppily extract resources releasing cancer causing pollutants (fracking, tar sands) and who deny people life saving health services to steal their insurance payments,

Or

The culling of a few murderous robber barons, motivated by our self defence, to stop such omnicidal behaviours, especially war mongering that creates profits for the MIC and vulture capitalists, which is driving us towards nuclear war?

They are highly functioning Sociopaths.

If you want to kill a movement, write an article like this. No, you do not expand the fight to take on capitalism. You do not humanize the CEO for UnitedHealthcare. And you do not make it about Trump – it’s funny how the CEO for UnitedHealthcare is a cog but Tump is not when in fact Trump is a cog. As Professor Richard Wolff said, Trump is a symptom of the inherent sickness of the system.

There is a visceral hatred of health insurance companies. This anger can easily galvanize people. Making this more than about health insurance companies will dissipate that anger. Your movement will fail. Start small, then grow. It would not take much for people to push for Medicare for all and make it a reality but to undo capitalism, would be an impossibility. People are angry at the health insurance industry. They are not angry about capitalism, not yet. And you do not have a replacement for capitalism. You have a replacement for the health insurance industry. Stay focused.

Well put…

Bernard screwed this all up several years ago when he got up on the stump during the debate and strongly advocated for “Med4All,” but he then went on to wholeheartedly include illegal immigrants in the coverage. What an instant loser! That approach is never going to get anything done on this.

The people could win on this issue if the line that’s hammered over and over and over is ‘Med4All for all U.S. Citizens!’ Bernard fouled it all up.

Med4All U.S. CITIZENS is a winnable issue as both liberals and many right leaning Republican types are in agreement. Yes, many rank-and-file GOP voters have finally seen the light on this.

Let’s get this done by sperging out on “Med4All U.S. CITIZENS!”